The Road Well Traveled: An Employee Perspective

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

Sustainability

Standards &

Frameworks Volume

1 - UN PRI

Welcome to the first installment of Bridge House Advisors’ Blog Series where we cover the “alphabet soup” of major standards, frameworks, and disclosure systems that affect and influence ESG and sustainability efforts for our clients. In this series, we will provide a basic overview of the standard or framework and the value they provide. We will also cover how Bridge House works with our clients in applying or supporting these frameworks into their ESG management programs. Lastly, we will cover any trends or pending changes that could impact how our clients apply these frameworks to their ESG & Sustainability efforts.

First up! United Nations Principles for Responsible Investment – UN PRI.

What is the UN PRI and Who is it for?

Founded in 2005, the UN PRI is a UN-supported organization aiming to define best practices in responsible investment and to encourage investor signatories across the globe to incorporate ESG considerations into their investment decisions. There are three types of signatories: Asset Owners, Asset Managers, and Service Providers. Organizations that become signatories commit to the six Principles that provide a framework for responsible and sustainable investment practices. Those six Principles are:

Once Asset owners’ and asset managers’ applications have been submitted and approved, they are then required to report annually on their ESG Program using the UN PRI Reporting Framework. Annual reporting covers firm-level and asset class-specific ESG policies, governance practices, and strategies.

What is the Value?

Perhaps the largest benefit in becoming a UN PRI signatory is that it demonstrates a public commitment to include ESG considerations in your investment decision making, which can ultimately lead to better access to capital for asset managers. Many triggers for asset managers to become signatories have come at the request of their Limited Partners (LP’s). LP’s who are looking for investee’s can lessen their due diligence burden with asset managers (General Partners or GP’s) that have strong UN PRI scores.

Bridge House became a signatory in June 2023 seeing the organization’s potential for identifying and standardizing industry best practices around responsible investment in line with the six Principles.

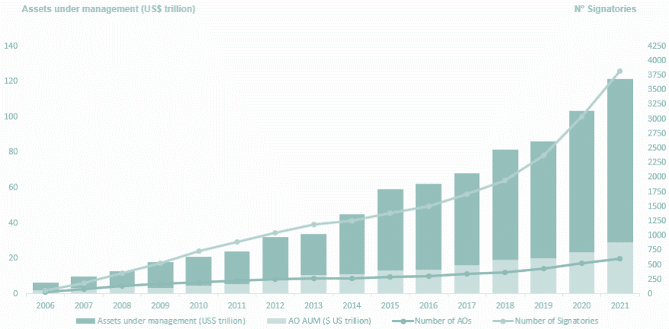

As a whole, the UN PRI has the potential to drive significant improvement in sustainability goals within the financial sector: over 7,000 signatories (up almost 50% from 2021) where total Assets Under Management (AUM) in reporting year 2021 were $121.3 Trillion USD1. What’s more, the UN PRI’s signatory base has shown consistent growth year over year since its inception.

Bridge House & the UN PRI

Bridge House supports current and potential UN PRI signatories with their reporting performance by providing a modeled score as if they submitted their ESG program information through the UN PRI Reporting Framework. In addition to providing an accurate estimate of what an actual client score might be, this modeled scoring exercise also facilitates an efficient reporting process through the UN PRI Framework when the actual submittal is due. Bridge House leverages the mock scoring results to provide a gap analysis summarizing where the client has opportunities to improve their score and, in so doing, enhance their ESG program. Bridge House uses an effort-value quadrant model where low-effort/high-value action items are prioritized prior to the client’s first or next round of reporting.

In addition to highlighting the areas where high value improvement could be made, Bridge House provides several services in those high impact areas where we directly work with clients to implement improvements in the target areas. Some examples are Climate Change and Emissions reporting and ESG Due Diligence Assessments.

Looking Ahead

While largely consistent from year to year, the UN PRI’s reporting framework is not static, and it adjusts to emphasize macro trends and evolving priorities in the world of responsible investment. For instance, questions about human rights, which are optional in the current framework, are likely to become mandatory in the future, and additional questions around topics like climate change may be incorporated as best practices are identified and modified. Responding to evolving ESG priorities will allow signatories to maintain strong and relevant ESG management programs as well as consistent access to investor capital. The UN PRI announced in December that the 2024 framework will remain unchanged from 2023.

Given the dynamic changes in regulatory disclosure in different markets, coupled with signatory feedback, the UN PRI board has taken a more flexible reporting approach for 2024. Reporting will be voluntary for all signatories that reported in 2023 or are in their grace period. For investor signatories that have yet to report, reporting will be mandatory. For several reasons, Bridge House suggests along with the UN PRI, to take advantage of the voluntary reporting opportunity in 2024. First, continued reporting demonstrates the signatory’s ongoing commitment to the six Principles. Second, signatories that have made changes to their ESG programs in 2023 should report in order to show progress against the previous reporting period. Bridge House can assist a client in estimating their new score before submitting to the UN PRI as well as helping the client prepare for their initial submittal if they have not yet reported. Third, signatories’ most recent reporting data will be included in UN PRI trend analysis that will help shape insights with signatory consultation to advance responsible investment practices among the signatories. Lastly, given the size and scale of participants noted earlier, UN PRI is recognized by many as a valuable accountability, transparency, and learning mechanism for best practices in responsible investing.

To learn more about UN PRI, how it can influence your ESG program, or to baseline or improve your reporting performance, contact one of our UN PRI Frameworks leads below.

Cade Paul

ESG Consultant

cpaul@bridgehouseadvisors.com

LinkedIn

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

One Year at Bridge House: An Employee Perspective Bridge House Advisors is super proud of…

2023 Bridge House Advisors CEO Interview – Christer Setterdahl Welcome to the launch of Bridge…