The Road Well Traveled: An Employee Perspective

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

Welcome to the third installment of Bridge House Advisors’ Blog Series where we cover the “alphabet soup” of major standards, frameworks, and disclosure systems that affect and influence ESG and sustainability efforts for our clients. In this series, we will provide a basic overview of the standard or framework and the value they provide. We will also cover how Bridge House works with our clients in applying or supporting these frameworks into their ESG management programs. Lastly, we will cover any trends or pending changes that could impact how our clients apply these frameworks to their ESG and sustainability efforts.

Next Up…The ESG Data Convergence Initiative – EDCI

What is EDCI and who is it for?

The EDCI began in 2021 when CalPERS and Carlyle started discussing ongoing challenges of collecting ESG data with a group of limited partners (LPs) and general partners (GPs). The EDCI grew out of these conversations as a global effort to streamline ESG data and reporting across private equity. The initiative is now led by an Advising Steering Committee comprised of leading GPs and LPs. By September 2022, the EDCI released its first Metrics Guidance Template and Data Submission form for the 2023 data collection cycle (2022 reporting year). These metrics spanned 6 ESG topics that are globally trackable by LPs, GPs, and their portfolio companies. By the end of the first data submissions period in April 2023, over 200 GPS and 100 LPS had signed on to the EDCI, totaling $26 Trillion in AUM. EDCI also allows membership to private credit investors and, investment consultants, as well as 2-way interaction with other ESG data platforms.

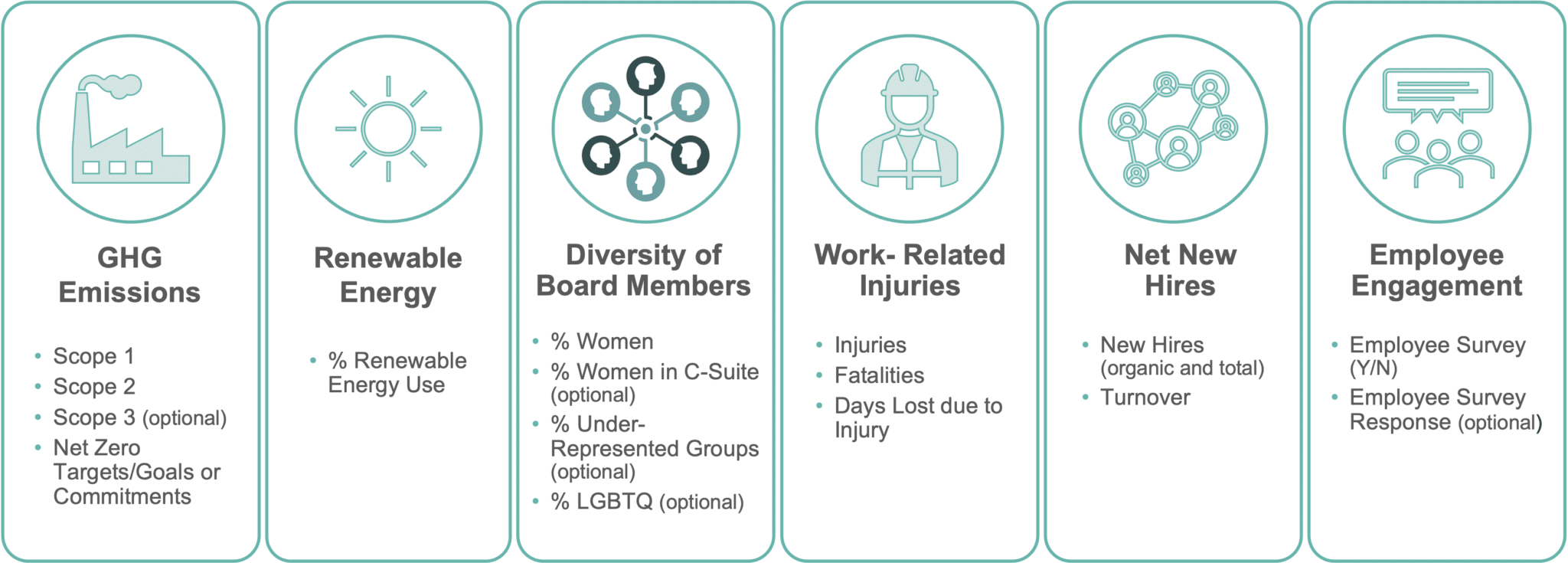

In September 2023, the EDCI updated the metrics to be collected by adding a net zero targets, goals, or commitments metrics for the 2024 calendar year (2023 reporting year). The current 2024 EDCI metrics are as follows:

Metrics are reported on an annual basis by April 30th. May through August activities include data aggregation, benchmark publication as well as metrics sprint where the EDCI steering committee discusses improvements or potential changes with reporting firms to the metrics for the upcoming year. The reporting observations and changes are finalized and released in September back to the member companies.

Why is EDCI important?

EDCI was established exclusively for private markets to standardize and simplify ESG metrics. This standardized, simplified set of metrics was established to accomplish the following:

Bridge House & EDCI

As part of Bridge House’s Firm Fund Service Group – Program Support services, we support many firms and their portfolio companies with collecting and disclosing this data. Bridge House also aims to collect additional metrics so that we can better support PE firms with tracking portfolio company performance for relevant or nuanced metrics. As an example, in many cases, we find that the EDCI request for total number of injuries does not allow for all data needed to calculate a total recordable incident rate (TRIR) which normalizes injury data indicating the average number of injuries, on average, per 100 employees. By collecting additional metrics beyond the EDCI metrics, Bridge House can calculate this number and track performance going forward so that we can identify areas of risk or opportunity to our clients.

Additionally, Bridge House’s Corporate Services Group can support with developing sustainability strategies, drafting data collection, calculating greenhouse gas (GHG) emissions data, and more, so that our clients and their portfolio companies are not burdened by this annual data collection effort. These additional services help build out programs to more easily collect, report, and manage this data for our clients and their portfolio companies.

Looking Ahead

2024 has a “data integration” theme for EDCI. Most notably a new optional metric has been added for net zero tracking. Including this metric will help the private sector better understand and improve net zero ambitions and strategies at the portfolio level.

The data integration themes revolve around expanded templates to support both EDCI and SFDR (Sustainable Finance Disclosure Regulation) reporting, enhanced benchmark visualization across software platforms, and outbound API’s connecting external users.

EDCI is unique in that it was built for private equity by private equity companies and their LPs. However, there are several other standards and frameworks like UN PRI or CDP among others that have just as much traction if not more than EDCI. Bridge House’s approach is always to provide a purpose-built reporting program that considers as many as the standards as possible, as well as the client’s pressure points (LP’s, customer requests, and regulators). This leads to a less burdensome process that can satisfy multiple requests over a reporting cycle for the portfolio company and its investors.

To learn more about EDCI and how it can influence your ESG Program, or if you need assistance with EDCI reporting, contact one of our EDCI framework leads below.

Brittany Bossel

bbossel@bridgehouseadvisors.com

LinkedIn

Rachel Wieclaw

rwieclaw@bridgehouseadvisors.com

LinkedIn

Cade Paul

cpaul@bridgehouseadvisors.com

LinkedIn

Stevie Cohen

scohen@bridgehouseadvisors.com

LinkedIn

Learn more about Bridge House Advisors’ story and get in contact with us.

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

One Year at Bridge House: An Employee Perspective Bridge House Advisors is super proud of…

2023 Bridge House Advisors CEO Interview – Christer Setterdahl Welcome to the launch of Bridge…