In the world of M&A, pre-investment due diligence has been a common practice for decades. Financial due diligence has always been a fundamental practice in responsible investing. It helps ensure investors fully understand the risks tied to a target company’s financials so they can make informed decisions. Over the years, investors have increasingly expanded the scope of their due diligence efforts, recognizing that financial and legal considerations are not the only factors that can impact the success of a deal or the return on an investment. Since the 1970s, investors have conducted environmental due diligence (EDD) to determine whether commercial real estate is compromised by environmental contamination and associated liabilities. In the 1990s, property condition assessments (PCAs) became the standard approach to understanding the condition of a property or structure that an investor may be purchasing, a lender financing, or a business leasing. Due diligence is intended to identify undisclosed liabilities, inconsistencies, or financial misrepresentations in an effort to protect capital, refine deal strategy, and optimize value creation post-acquisition. It’s not just about verifying numbers — it’s about ensuring that the investment aligns with the broader strategic and financial goals of the investor.

Aligning with financial due diligence, many investors have recently further expanded their due diligence efforts to include ESG (Environmental, Social, and Governance) due diligence – a targeted review of potentially material ESG considerations that are not necessarily financial in nature but can have significant financial or reputational implications if not managed effectively.

A key consideration in each of these due diligence workstreams is the concept of materiality. While not necessarily identical to financial materiality, the idea is similar in that the materiality lens helps focus the due diligence workstreams on topics that are most significant to the business and the investor. A workstream or topic should only be considered in due diligence if it has the potential to impact the targeted company’s financial performance or reputation, positively or negatively. For example, environmental liability is likely more material to a deal involving a chemical manufacturing business operating out of an owned facility built in the 1960s than to a deal involving a 3-year-old software business with an entirely remote workforce. Similarly, occupational health and safety is likely more material to the former than the latter, whereas data privacy and security may be more material to the latter.

The ultimate purpose of these pre-investment due diligence assessments is to proactively identify current or potential risks to the business and its potential new sponsor, as well as opportunities to create incremental value moving forward.

With ESG due diligence in particular, the idea of incremental “value creation” can be the primary impetus for conducting the assessment. For many businesses, especially in the middle market, poor management of ESG topics can often result in “profit leaks” that directly impact a company’s EBITDA, simply because they have never been actively measured or adequately managed. During pre-investment due diligence projects, Bridge House often encounters companies who are “more lucky than good”. Frequent profit leaks can relate to topics commonly assessed during ESG due diligence, such as employee turnover, energy consumption, and health and safety performance. If relevant but unmanaged, these issues can result in additional operational costs that may erode the enterprise value of a business. These costs can be captured and sustained by a proactive approach, and proper management systems, during the investment lifecycle.

As investors continue to broaden their due diligence efforts, another critical area has emerged: physical climate risk assessments.

While ESG due diligence generally focuses on a company’s current or past performance with respect to environmental, social, and governance factors, physical climate risk assessments are designed to address the future impacts of a changing climate on assets and operations. These assessments evaluate risks such as extreme weather events, rising sea levels, and changing temperature patterns, which can significantly affect the long-term viability and value of investments.

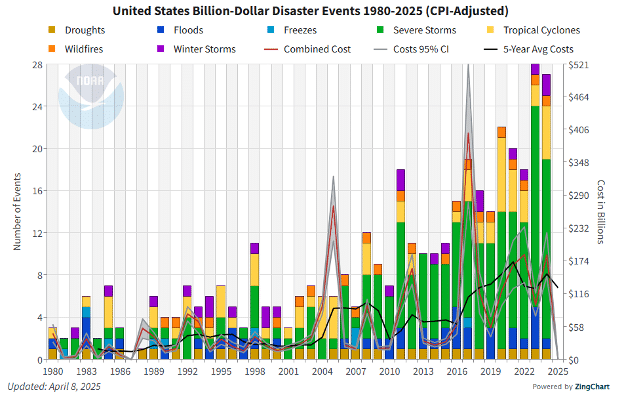

As the impacts of climate change intensify across the United States and the world, the consequences are becoming increasingly evident. This is reflected in both the frequency and severity of weather-related disasters and the financial consequences that result. From devastating wildfires to record-breaking storms, these events are not only causing significant loss of life and property but are also destabilizing critical sectors such as insurance and finance. The rising costs associated with these disasters, coupled with evolving regulatory demands for climate-related risk disclosure, are prompting businesses and investors to reassess their strategies.

As noted in the chart below, there has been a steady increase in annual losses over the past four decades with the costs almost doubling in the last two decades.[1]

While most companies and investors are not currently subject to explicit, legally-mandated disclosure requirements, many are proactively evaluating processes to collect data and to better understand their potential financial risk profiles, regardless of whether they choose to disclose this information. And consolidated frameworks, such as the recommendations of the former Task Force on Climate-related Financial Disclosures (TCFD) and the International Financial Reporting Standards (IFRS) Foundation’s Sustainability Disclosure Standard S2 provide valuable guidelines. These frameworks can help companies and investors prepare for future reporting obligations.

Over the past 50 years, climate data collection, interpretation, rigorous hindcasting, and predictive modeling have made significant strides. For example, a five-day weather forecast today is generally as accurate as a 24-hour forecast was in 1980. Climate models prepared in the 1970-1990s have been remarkably close to their 20- and 30-year predictions, and progress continues.

Effectively characterizing and evaluating these climate risks through improved data and analysis can enhance decision-making and help mitigate financial risks associated with the impacts of climate change. Understanding and managing risk is fundamental to capitalism, enabling businesses and investors to make informed decisions, allocate resources efficiently, and maximize returns for long-term success.

Yet, many investors we speak with have yet to undertake physical climate risk assessments during pre-investment due diligence.

Some express concerns about “signaling” to insurance companies that their assets are at risk, the expense and time required, and the additional demands on their management teams. Others are hesitant due to the timeframe of the forecast, recognizing that with private market M&A, they may not hold the investment long enough to experience the future impacts of the identified risks. We’ve addressed some of these misconceptions below:

If I conduct a physical climate risk assessment, won’t I signal to my insurance provider that my assets are at risk?

Your insurance provider has likely conducted a similar, historical assessment of related risks, and is also likely beginning to consider how those risks may change over time. Climate risks are destabilizing insurance markets, particularly in areas with high wildfire, flood, and tropical cyclone risks. As a result, insurers have begun actively modeling potential risks and passing more risk onto policyholders through higher premiums, reduced coverage, stricter contract terms, and increased deductibles to fortify assets against future damage. In some regions, insurers are pulling out altogether. Conducting the assessment will equip you with similar information as your insurer and can inform strategies to mitigate the impact of a business interruption, or give you ammunition to challenge the analysis performed by your insurance carrier.

The models predict the change in risk over the next 30 to 50 years. I won’t hold this company and its assets then, so why should I concern myself with this type of assessment?

While you as the current investor may not experience the long-term effects of climate change on a given investment, future investors will. Additionally, future, or other prospective buyers, may very well do their own climate risk assessment and price in these risks – if you don’t, you may risk overpaying for the asset given its risk profile. With the growing prevalence of climate risk modeling, reporting, and mitigation, future sponsors may find it valuable that the risks have already been modeled and mitigation strategies have been defined (but not necessarily executed) to reduce the impacts of future risks. Plus, our team can run modeling for the next 5-, 15-, or 30-year time windows to provide insight into more immediate risks. Either way, having conducted this sort of assessment can only help you at exit.

I’m already asking so much from my management team; I don’t want to add another burdensome request.

Physical climate risk assessments are a light-touch workstream. All you need to collect is the addresses of the facilities – the models and our team of analysts can do the rest.

I just don’t understand what I will do with this information; I mean, what if the models don’t identify any risk?

First, if no elevated risk of hazards is identified, then you will have a defensible rationale for why you do not need to consider additional mitigation steps – a rationale that you can articulate to your next buyer. You may also identify that an asset is relatively low risk in a region with high risks, in which case it may outperform its peer assets. However, if elevated risks are identified during due diligence, you may avoid overpaying for an asset that needs re-enforcement and/or will have higher insurance premiums and may be able to incorporate the risk of extended business interruptions into your valuation. Post-investment, you can evaluate current mitigation strategies, assess their effectiveness, and implement additional mechanisms to allay the identified impacts.

I’m sure it’s expensive, I’m not sure it will add enough value to justify the cost.

While expenses differ by platform, generally a physical climate risk assessment can be completed for $350/site or less. With a 10-facility portfolio, $3,500 can deliver insights into the future resiliency of each asset, allow you to upgrade and create strategies to mitigate impacts, and equip your company with a better understanding of what risks they should be planning for. It’s cheap, it’s useful, just do it.

Incorporating physical climate risk analysis into due diligence processes allows investors to identify vulnerabilities and develop strategies to mitigate these risks, leading to more resilient and sustainable investments. As climate change continues to pose increasing threats, understanding and addressing these risks, when material, has become essential for informed decision-making in M&A transactions.

[1] NOAA National Centers for Environmental Information (NCEI) U.S. Billion-Dollar Weather and Climate Disasters (2025). https://www.ncei.noaa.gov/access/billions/, DOI: 10.25921/stkw-7w73

Cade Paul

ESG Consultant