Sustainability and ESG Programs: Platforms for Value Creation

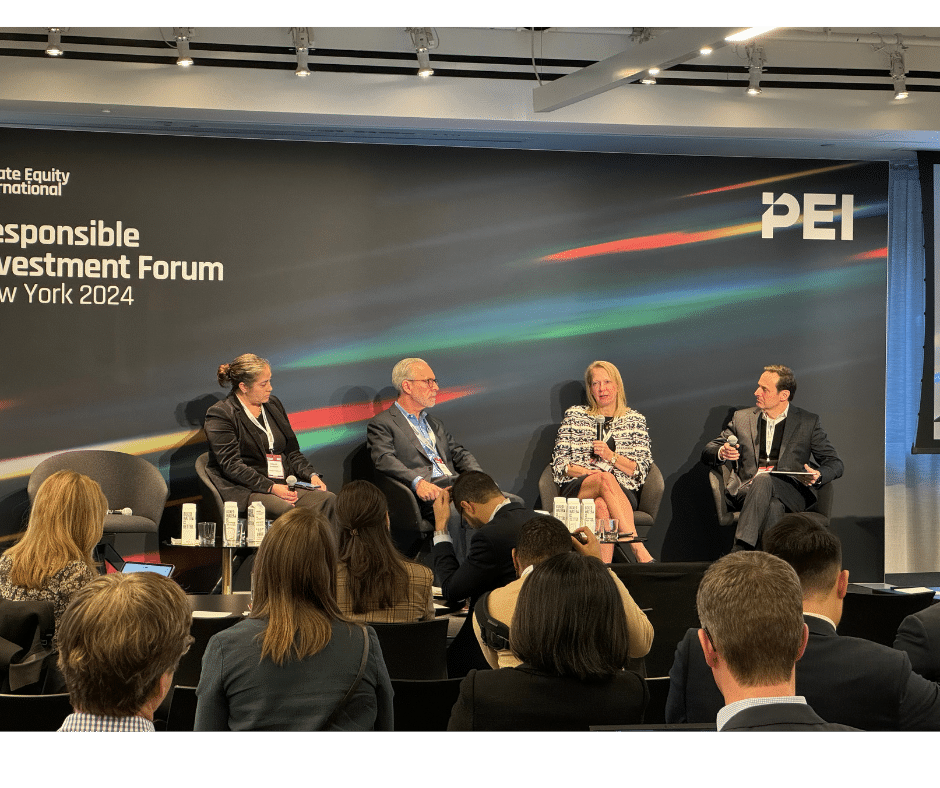

The Bridge House crew had a busy February week in New York City. We were a lead sponsor at the Private Equity International – Responsible Investment Forum where our very own William Pleasant moderated a diverse panel covering portfolio company perspectives on sustainability and ESG performance. Thanks to our panelists Don Anderson (Owner-Portfolio Solutions), Beverly Gates (EVP and Chief Legal Officer – Monogram Foods), and Allison Gosselin (Director, ESG – Graham Partners).

Jeff Gibbons also facilitated an afternoon working session, along with Jennifer Flood (InvestIndustrial), about practical ways PE sponsors can work with portfolio companies on engagement and value creation initiatives. Later that week, William participated in the IFRS Sustainability Symposium which included a different audience set from the PEI conference – larger companies, financial institutions, NGO’s, regulators, and academics.

The prevailing theme, especially in the private markets, is reminiscent of the famous rallying cry of movie character, Rod Tidwell: “Show me the money!”. The metrics, footprints, and reporting will continue to shake out and ultimately standardize. However, the driver for sustainability and ESG programs, and the prize, is the very real ability to improve EBITDA and ultimately enhance exit valuations. This is in lockstep with how Bridge House approaches defining and building purposely built ESG and sustainability programs for our clients. Smart programs that line up with the overall business strategy of both sponsor and management team to create tangible business value.

Don’t let letters and reports get in the way

There are a myriad of frameworks and standards across public and private markets that cover the alphabet soup multiple times over, which is leading to ESG fatigue. Requests to comply with certain standards are often what gets portfolio companies and their General Partners started on their sustainability or ESG program. Even taking this sort of reactive approach often results in companies finding direct value in categories like energy management, water usage, waste management, and employee safety. But companies willing to think beyond reactive reporting and survey responses can go even further. Bridge House understands that every business is unique, and the key to maximizing value out of a ESG/Sustainability program is identifying what sustainability-related topics are material for the company. Assessing what is material for your business and then organizing around those material topics will set your program up for more robust and holistic benefits, versus the one-offs that you stumbled into because you were required to comply with framework report request. You can see how important the materiality question is in Our Carbon Rant.

In addition to understanding materiality, an effective sustainability program recognizes the need for “proportionality”, a concept adopted by leading standards and best practices. An example is found in the new S1 and S2 standards from ISSB, which state that companies should use an “approach that is commensurate with the skills, capabilities and resources that are available” and are not required to “expend undue cost or effort to collect information for reporting.”

Regardless of how the company first arrives at the need for a sustainability program, you do not want to kick-off your ESG or sustainability program with burdensome requests for metrics and reports. Both our portfolio and General Partner panelists noted that educating company leadership on the value creation opportunity of the program was critical to obtaining buy-in and accountability. It is also important to help the company stay one step ahead of reporting requests with templates, or more focused training. You also need to be realistic and set expectations that some of the compliance and reporting activities are heavier lifts than others. Ultimately the goal is to deliver a better bottom line and build a better company.

An example of taking a “material + proportional” approach to sustainability can be found in emissions reporting. Our panelists suggested that instead of getting bogged down in the details of a carbon footprint, companies might instead start with energy consumption first to size the prize, so that tracking your emissions becomes one measurement component to the real financial results you will have achieved by implementing a proactive energy management program.

Incidentally, “Scope 3” emissions reporting took on the role of the sustainability boogeyman during our week in New York City. The increasingly loud chorus heard at both events is that Scope 3 is too nebulous, too hard, and too untrustworthy to be required in mandatory reporting. On cue, the rumors began to circulate that the US SEC is pulling Scope 3 out of its proposed rulemaking.

Treat it like a Transformation

Your ESG or Sustainability Program should not be executed as a separate set of projects or a practice of collecting random metrics on topics you may or may not have tracked before. By intentionally focusing on the right material topics, your program can be part of an integrated, strategic business transformation. Executed this way, the ultimate reporting is measuring progress towards your desired financial and operational goals while creating a better, more resilient company. In many cases, the company is already progressing uncoordinated efforts related to material ESG topics but just not calling it out. In these scenarios, program develop can be more of a guiding process of seeing these efforts through an ESG lens while continuing to drive the identified value.

Taking it a step further, getting material ESG / sustainability topics (and the value they will drive) into the conversation as early as the deal thesis will help facilitate the delivery of the desired outcomes. It also makes adoption of the efforts more natural at the portfolio companies.

Bridge House’s Firm Fund and Corporate Services teams are built on the premise of helping make our clients more successful.

Learn more about Bridge House Advisors’ story and get in contact with us.