The Road Well Traveled: An Employee Perspective

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

Welcome to the fourth installment of Bridge House Advisors’ Blog Series where we cover the “alphabet soup” of major standards, frameworks, and disclosure systems that affect and influence ESG and sustainability efforts for our clients. In this series, we will provide a basic overview of the standard or framework and the value they provide. We will also cover how Bridge House works with our clients in applying or supporting these frameworks into their ESG management programs. Lastly, we will cover any trends or pending changes that could impact how our clients apply these frameworks to their ESG and sustainability efforts.

What is CSRD and who is it for?

Over the course of 2021 and 2022, the European Union (EU) proposed, adopted, and ultimately published the Corporate Sustainability Reporting Directive (CSRD), which became effective on January 5, 2023. The CSRD introduces an in-depth standardized framework for disclosing non-financial information and data. Starting in 2024, the new legislation will impact approximately 12,000 EU-based companies, formerly subject to the Non-Financial Reporting Directive (NFRD) reporting standards. However, one of the notable differences between NFRD and CSRD is the increased number of companies which will be subject to reporting in the coming years. Eventually, CSRD is estimated to affect more than 50,000 EU-based and 10,000 non-EU firms and companies, including companies with operations in the United States.

Why is CSRD important?

Simply put, the CSRD is important as it will require a level of ESG data collection and reporting that is comparable to traditional financial reporting requirements. Many companies are either currently subject to or are soon to be subject to these requirements (see Looking Ahead below). As a whole, the reporting regime enables companies to demonstrate their commitment to ethical and sustainable business practices, which can contribute to long-term business success, value for investors, and the well-being of all stakeholders.

According to the EU, the purpose of the CSRD is to require covered companies to “disclose information on what [the companies] see as the risks and opportunities arising from social and environmental issues, and on the impact of their activities on people and the environment.” The stated goal is to promote transparency and provide potential investors, consumers, and other stakeholders an understanding of how companies are performing using ESG metrics. Doing so will allow investors to make informed decisions for sustainable investments and enable them to manage ESG-related financial risks. The CSRD also provides a standardized format for information disclosure and reporting.

Companies and investment firms that embrace CSRD may gain a competitive advantage by differentiating themselves from their peers. The transparency from CSRD reporting will foster a sense of accountability and trust between companies and their stakeholders. This trust is essential for promoting positive relationships with customers, investors, employees, and the general public. By demonstrating their sustainability initiatives, ESG risk management practices, and commitment to social responsibility, companies can enhance their reputation, increase brand loyalty, improve customer satisfaction, and generate financial value to investors. In addition, consumers are increasingly considering social and environmental factors when making decisions, so companies that demonstrate strong sustainability practices through their CSRD disclosures may improve revenue and add additional value for their investors.

Bridge House & CSRD

Bridge House’s Corporate Services Group can support with developing sustainability strategies, organizing data collection, calculating greenhouse gas (GHG) emissions data, and more, so that our clients are not burdened by this annual data collection effort. These additional services assist in establishing programs that facilitate the collection, reporting, and management of data for both our clients and their portfolio companies.

Additionally, as part of Bridge House’s Firm Fund Service Group , we can support private equity firms with their portfolio companies by determining CSRD-applicability, collecting data, narrative development, and reporting. For first-time submitters, the process of gathering relevant data and meeting CSRD’s criteria might appear daunting, but Bridge House’s team of experts is able to step in and simplify the process. For returning submitters, we help enhance disclosures to maximize opportunities for value creation for the current year and provide insights on areas for future improvement.

Looking Ahead

The first step for a company that is potentially subject to CSRD requirements is to determine which upcoming reporting year will apply. As stated above, companies already included within the scope of the NFRD are required to produce a 2024 CSRD report (to be published in 2025), i.e., all pertinent data/information collection for 2024 should already be underway. The start of CSRD applicability for each reporting year is outlined below:

2024 Reports (submitted in 2025) – Companies already subject to NFRD.

2025 Reports – Large EU-based organizations that meet at least two of the three following criteria:

2026 Reports – EU organizations listed as small and medium enterprises (SMEs), as defined by the European Commission, which meet at least two of the three following criteria:

2028 Reports – non-EU companies which conduct significant business activity within the EU. This includes companies that:

The second step for all companies who may be subject to upcoming CSRD reporting requirements will be to conduct double materiality assessments. These double materiality assessments must consider material impacts (1) TO the company’s operations and (2) FROM the company on the general public, community, and environment.

Per the European Sustainability Reporting Standards (ESRS), a sustainability issue is considered “material” if it meets the criteria outlined for impact materiality, financial materiality, or both. The two materiality categories are defined by ESRS as follows:

Impact Materiality: A sustainability matter is material from an impact perspective when it pertains to the undertaking’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long-term. Impacts include those connected with the undertaking’s own operations and upstream and downstream value chain, including through its products and services, as well as through its business relationships. Business relationships include those in the undertaking’s upstream and downstream value chain and are not limited to direct contractual relationships.

Financial Materiality: A sustainability matter is material from a financial perspective if it triggers or could reasonably be expected to trigger material financial effects on the undertaking. This is the case when a sustainability matter generates risks or opportunities that have a material influence, or could reasonably be expected to have a material influence, on the undertaking’s development, financial position, financial performance, cash flows, access to finance or cost of capital over the short-, medium- or long-term. Risks and opportunities may derive from past events or future events.

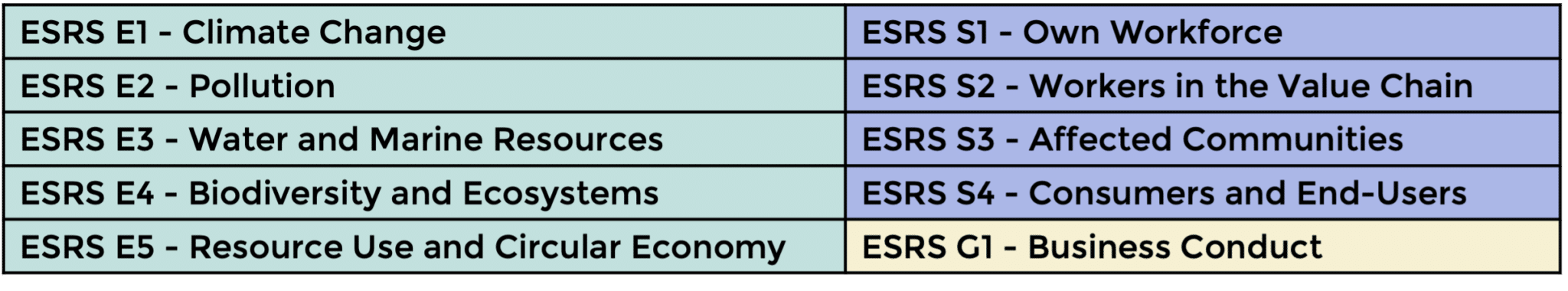

The CSRD indicates that companies must consider the following environmental (E), social (S), and governance (G) issues, per the ESRS framework, during their materiality assessments.

After the materiality assessment is complete, the CSRD requires that companies disclose information as outlined by the ESRS. Following the General Requirements (ESRS 1) and General Disclosures (ESRS 2), if an issue is deemed material, companies must track and disclose information for the material issue for an entire year.

With the CSRD reporting requirements quickly approaching, Bridge House is eager and willing to support clients to review alignment, conduct double materiality assessments, develop sustainability strategies, implement the necessary tools to track all information needed to fulfill the disclosure requirements, and assist with reporting. Although it may be a few years before the CSRD applies directly to a specific company, especially those in the United States, it is never too early to assess alignment and get started on materiality. Further, companies that sell into large European customers are likely to face information demands soon as these customers work to meet their own reporting requirements. Our team of experts is on standby to help our clients with their CSRD needs.

To learn more about the CSRD and how it can influence your Sustainability Program, or to baseline and improve your reporting performance, contact one of our CSRD Framework leads below.

Will Gardiner

wgardiner@bridgehouseadvisors.com

LinkedIn

Jessica Atar

jatar@bridgehouseadvisors.com

LinkedIn

William Pleasant

wpleasant@bridgehouseadvisors.com

LinkedIn

Learn more about Bridge House Advisors’ story and get in contact with us.

Also, please check out our other installments of the “Alphabet Soup” series!

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

One Year at Bridge House: An Employee Perspective Bridge House Advisors is super proud of…

2023 Bridge House Advisors CEO Interview – Christer Setterdahl Welcome to the launch of Bridge…