The Road Well Traveled: An Employee Perspective

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

Welcome to the 6th installment of Bridge House Advisors’ Blog Series where we cover the “alphabet soup” of major standards, frameworks, and disclosure systems that affect and influence ESG and sustainability efforts for our clients. In this series, we will provide a basic overview of the standard or framework and the value they provide. We will also cover how Bridge House works with our clients in applying or supporting these frameworks into their ESG management programs. Lastly, we will cover any trends or pending changes that could impact how our clients apply these frameworks to their ESG and sustainability efforts. In this installment we will be covering SFDR (Sustainable Finance Disclosure Regulation).

What is SFDR and who is it for?

The European Union (EU) began work on SFDR in 2018 and the regulation was enacted in March 2021, with requirements in effect as of January 2023. This EU regulation (EU 2019/2088) is implemented by the European Securities and Markets Authority (ESMA) but enforcement is delegated to individual EU country market authorities.

It’s important to note that SFDR directly covers funds marketing to investors in the EU and requires these funds to self-classify according to their investment objectives, ESG policies, and associated ESG risk assessment and management (more details below). However, many US Private Equity (PE) firms and funds that are not directly marketing in the EU are asked by their investors such as Limited Partnership (LP) firms to comply with SFDR metric collection requirements. This article focuses on SFDR from the perspective of US PE firms including key requirements and insights from Bridge House’s experience.

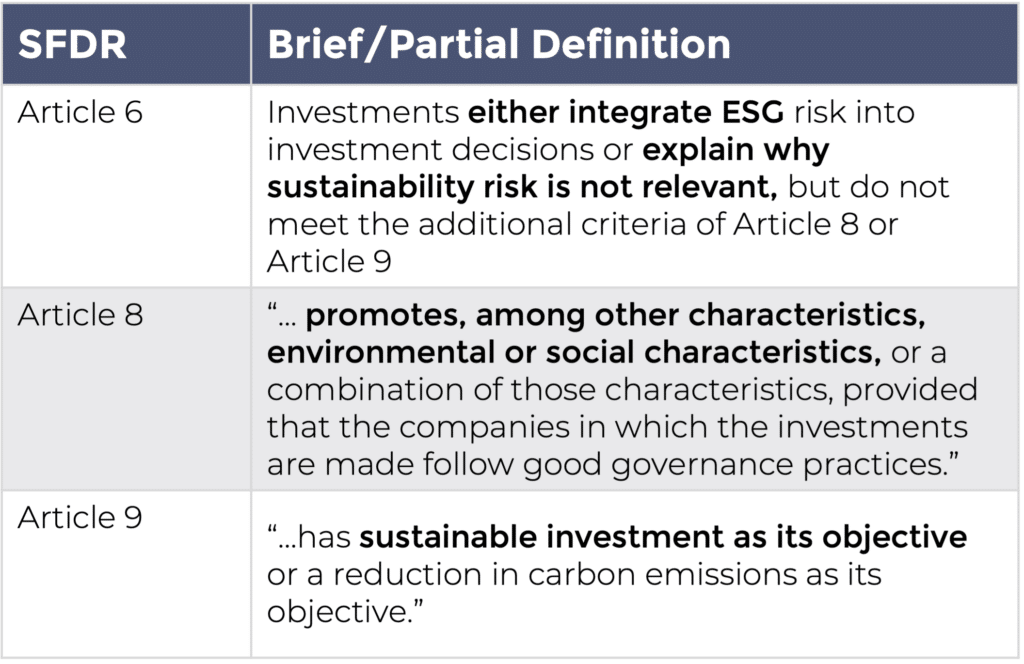

Specifically, funds marketed in the EU are asked to self-classify into one of the following categories:

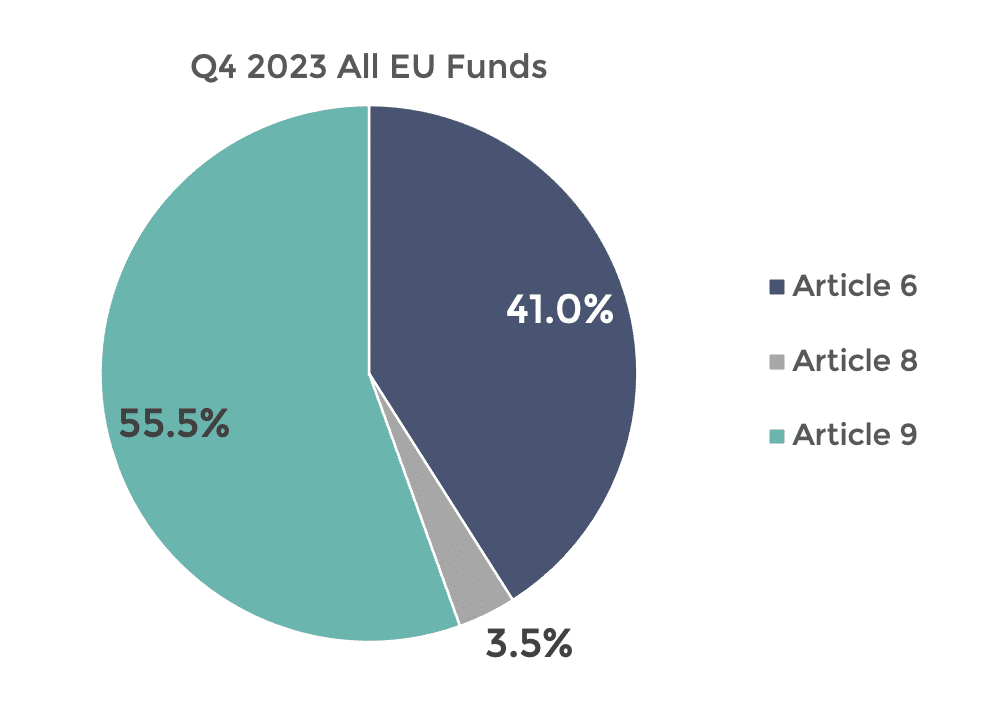

[1] Morningstar, SFDR Article 8 and Article 9 Funds: Q4 2023 in Review

Assets in Article 8 and Article 9 funds increased by 1.7% over Q4 of 2023, driven mostly by market depreciation and, to a lesser extent, the redemptions from Article 8 products. In comparison, Article 6 fund assets decreased by 2.4% over the same period. The number of Article 8 and 9 funds also increased in Q4 2023 to over 12,500 funds. There are many instances where funds have ESG programs in place, but are not ready to meet all the requirements for Article 8 funds so firms elect to classify as Article 6 until they are prepared to meet the disclosure obligations.

Why is SFDR important?

For both directly regulated EU funds and non-EU funds seeking EU investors, SFDR is driving substantial metrics collection and public disclosure, to improve transparency around ESG integration. This level of disclosure is new to firms and funds, and there are technical metric collection challenges and public disclosure considerations. However, SFDR is consistent with other global trends towards sustainability disclosure and is a big step towards increased transparency around ESG factors.

While the US doesn’t currently have a directly equivalent regulation, EU-based LPs classified under Articles 8 and 9 are now requiring metrics collection from US-based PE firms that are seeking to raise funds from those LPs. In addition, it is reasonable to expect that with the growth of ESG investing, US regulations and standards are likely to evolve in a similar direction to SFDR over time. As such, understanding SFDR requirements may help US investors prepare for potential future regulations.

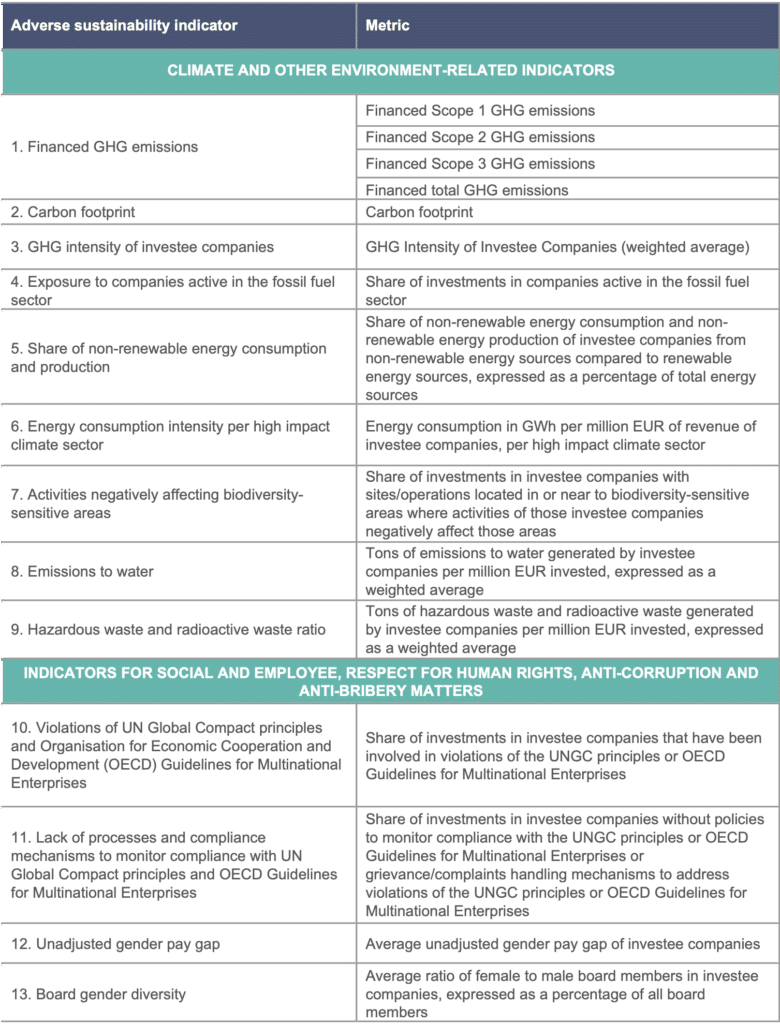

SFDR requires collection of 14 Principal Adverse Impact (PAI) metrics, which are calculated from as many as 90 individual data points. The 14 PAIs include Scope 1, 2, and 3 GHG emissions, eight environmental metrics , and five social/governance metrics listed in Table 1 below. In addition to the 14 PAIs, there are sector-specific metrics and voluntary additional disclosures. Article 8 and 9 funds are required to post the PAIs and additional ESG disclosures on their websites annually (by June 30). Disclosure of SFDR sustainability metrics helps companies demonstrate their commitment to ethical and sustainable business practices, which can contribute to long-term business success and value for investors.

Bridge House & SFDR

Bridge House’s Firm Fund Service Group supports private equity firms and their portfolio companies by determining SFDR-applicability and assisting with collection and reporting of metrics (PAIs) required by the regulation. In most cases clients are already collecting other metrics, such as those requested by the ESG Data Collection Initiative (EDCI), and we help clients streamline data collection and avoid duplication.

Bridge House’s team of experts can simplify the process for first-time submitters, and we work with in-house tools and a variety of outside data management providers to meet client needs. We also assist returning submitters by providing trending and benchmarking within funds or across the sector to provide actionable data for clients looking to improve ESG metric performance and add value to individual portfolio companies.

Looking Ahead

From the perspective of US PE firms in most cases the fund is not directly marketed in the EU and will not need to classify itself as Article 6, 8, or 9. The steps below assume that a US PE firm is responding to requests from Article 8 or 9 investors.

The first step for a company that is potentially subject to SFDR disclosure requirements is to identify current firm metric collection efforts and plan individual metric collection to avoid duplication of effort. As stated above, companies are required to post PAI disclosures by June 30 annually for the prior calendar year, therefore investors would seek to obtain metrics prior to June to consolidate metrics data.

The second step for firms planning to collect SFDR metrics is to plan data storage to allow both SFDR reporting (assuming this is to an LP rather than directly to the public via a firm webpage) and make use of the PAIs for trending and benchmarking. The data can be very useful in identifying and measuring trends over time, performance against peers in a portfolio, and within a sector. This analysis can uncover opportunities such as energy savings, employee safety improvements, and resource use, which can all be improved to ultimately increase company value.

With the SFDR 2024 reporting date quickly approaching, Bridge House is supporting clients with their 2023 metrics including full-service data collection, carbon footprinting, quality control, data management, and reporting. Although some private equity firms, particularly in the US, have not started collecting metrics for SFDR, proactive assessment of current metrics against the SFDR framework can reveal the potential effort needed for future compliance. This allows for quicker data collection when EU investors such as EU LPs, request information for their own SFDR reporting obligations. Our team of experts is here to assist you with all your SFDR needs.

To learn more about SFDR and how it can influence your firm/fund metrics collection or fundraising, contact one of our SFDR Framework leads below.

Giorgio Molinario

gmolinario@bridgehouseadvisors.com

LinkedIn

Laura Miller

lmiller@bridgehouseadvisors.com

LinkedIn

Brittany Bossel

bbossel@bridgehouseadvisors.com

LinkedIn

Learn more about Bridge House Advisors’ story and get in contact with us.

Also, please check out our other installments of the “Alphabet Soup” series!

Table 1 – Principal Adverse Impact (PAI) Indicators

The Road Well Traveled: An Employee Perspective Bridge House Advisors is super proud of our…

One Year at Bridge House: An Employee Perspective Bridge House Advisors is super proud of…

2023 Bridge House Advisors CEO Interview – Christer Setterdahl Welcome to the launch of Bridge…